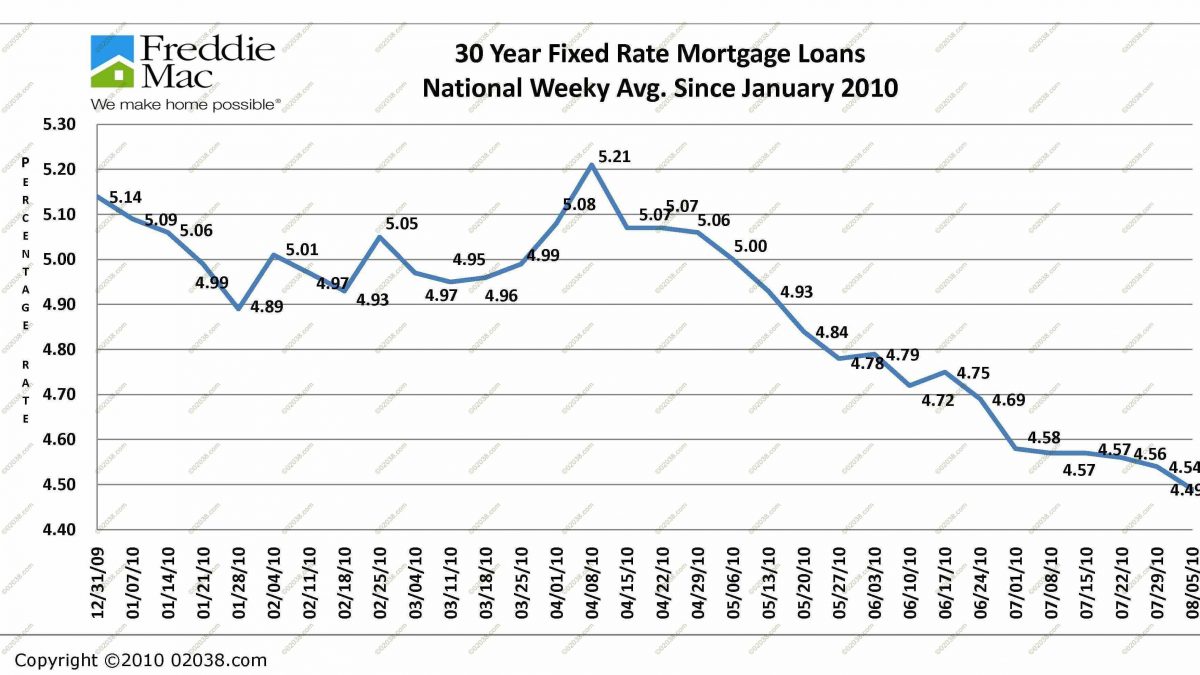

20+ Freddie mac mortgage

When selecting the term of a fixed-rate mortgage it is important to understand the features and benefits of each. The latest 20-year mortgage rate averaged 508 while last week it averaged 474 percent.

2

Or even 20 down.

. Standard averaged rates are calculated based on Freddie Macs Weekly Mortgage Market Survey. 30 and 15 years. In fact a Freddie Mac survey found that nearly one-third of prospective homebuyers think the same.

Contrary to popular belief the typical homebuyer makes a down payment between 5 and 20 of the purchase price and some mortgage programs make it possible to put down as little as 3. Freddie Macs OTCQBFMCC total mortgage portfolio expanded at an annualized rate of 25 in July easing from 39 in June and 84 in July 2021 according to the companys monthly volume. Acceptable zoning classifications include legal legal non-conforming or locations with no zoning.

One ADU is allowed on 1- 2- and 3-unit properties. Accessory Dwelling Unit Requirements. HUD-Guaranteed Section 184 Native American Mortgages.

The amount that you put down when buying a home will. Get the Right Housing Loan for Your Needs. Ad Compare Your Best Mortgage Loans View Rates.

The Freddie Mac HFA Advantage mortgage is a conventional mortgage product available exclusively to housing finance agencies HFAs seeking strategic solutions to diversify their product offerings and portfolio mix. Ad Were Americas 1 Online Lender. 15 and 30 years.

Ad Top Home Loans. 2 weeks ago the rate was at 48 and 4 weeks ago it was at. Freddie Mac makes mortgage lending less risky for banks expands the pool of buyers and.

Compare Offers Side by Side with LendingTree. Many also offer 20-year fixed-rate mortgages and some lenders offer even more terms. A 3 down paymnt.

This 20 year mortgage rate is a result of interpolation calculation of standard periods. To qualify for a Home Possible mortgage loan you have to meet eligibility requirements set by Freddie Mac and your lender. Apply Start Your Home Loan Today.

The Guide on AllRegs is the official electronic version of the Single-Family SellerServicer Guide. Introduced in 2018 Freddie Macs HomeOne mortgage loan is designed to make financing more accessible for prospective home buyers as well as homeowners looking to refinance. A 1- 2- or 3-unit property with an ADU must comply with the zoning and land use requirements for the jurisdiction in which its located.

Most mortgage lenders offer at least two basic terms. November 20 2021 Matthew Good IN THIS GUIDE The Federal Home Loan Mortgage Corporation Freddie Mac is a government-backed corporation that buys mortgages from certified lenders and packages these mortgages into mortgage-backed securities. Comprehensive PDF that contains all chapters of the Guide as of the last published Guide Bulletin with Guide updates.

A 660 or higher credit score.

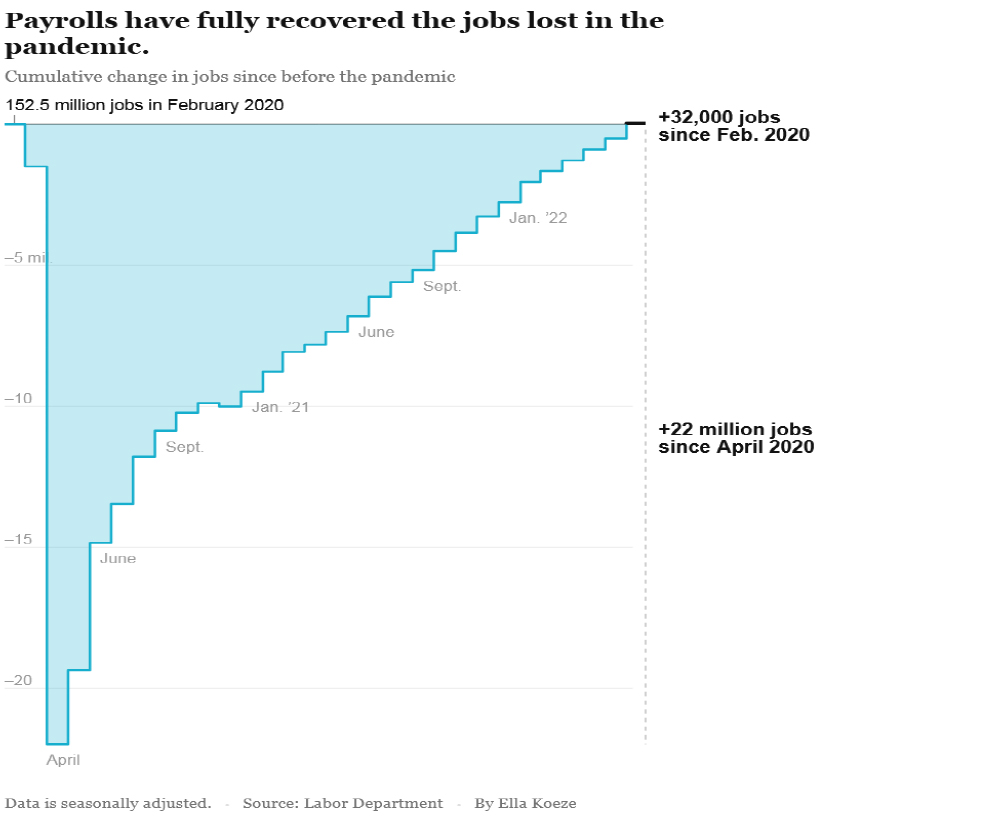

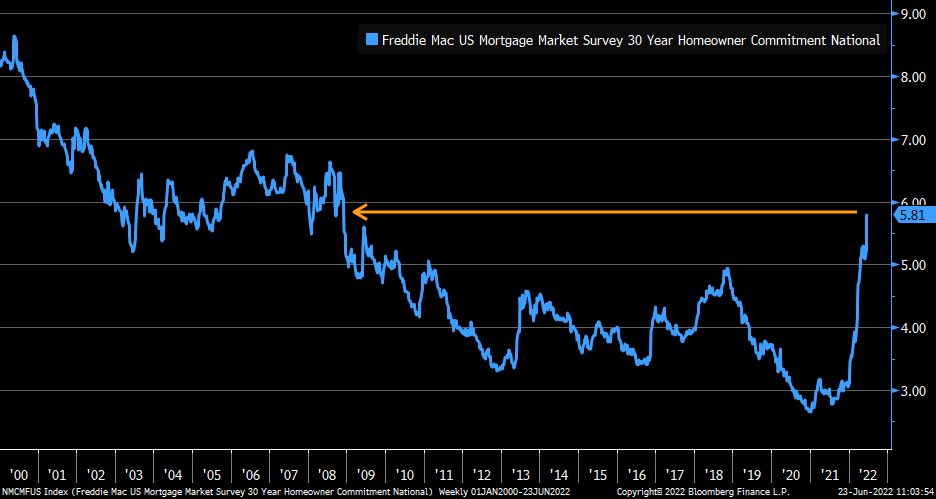

Market Observations July 2022 Recap

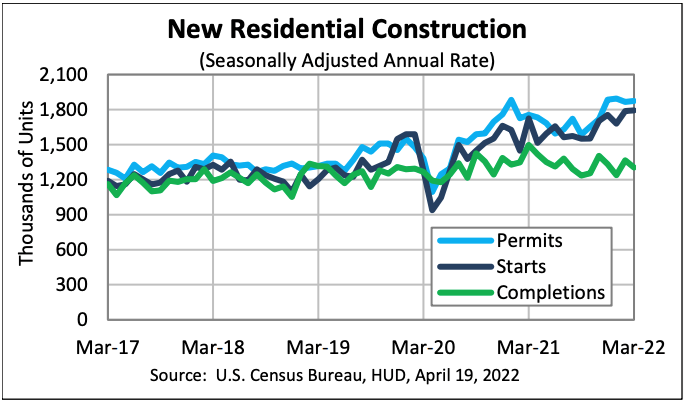

Myers Building Product Specialists May Supply Chain Update

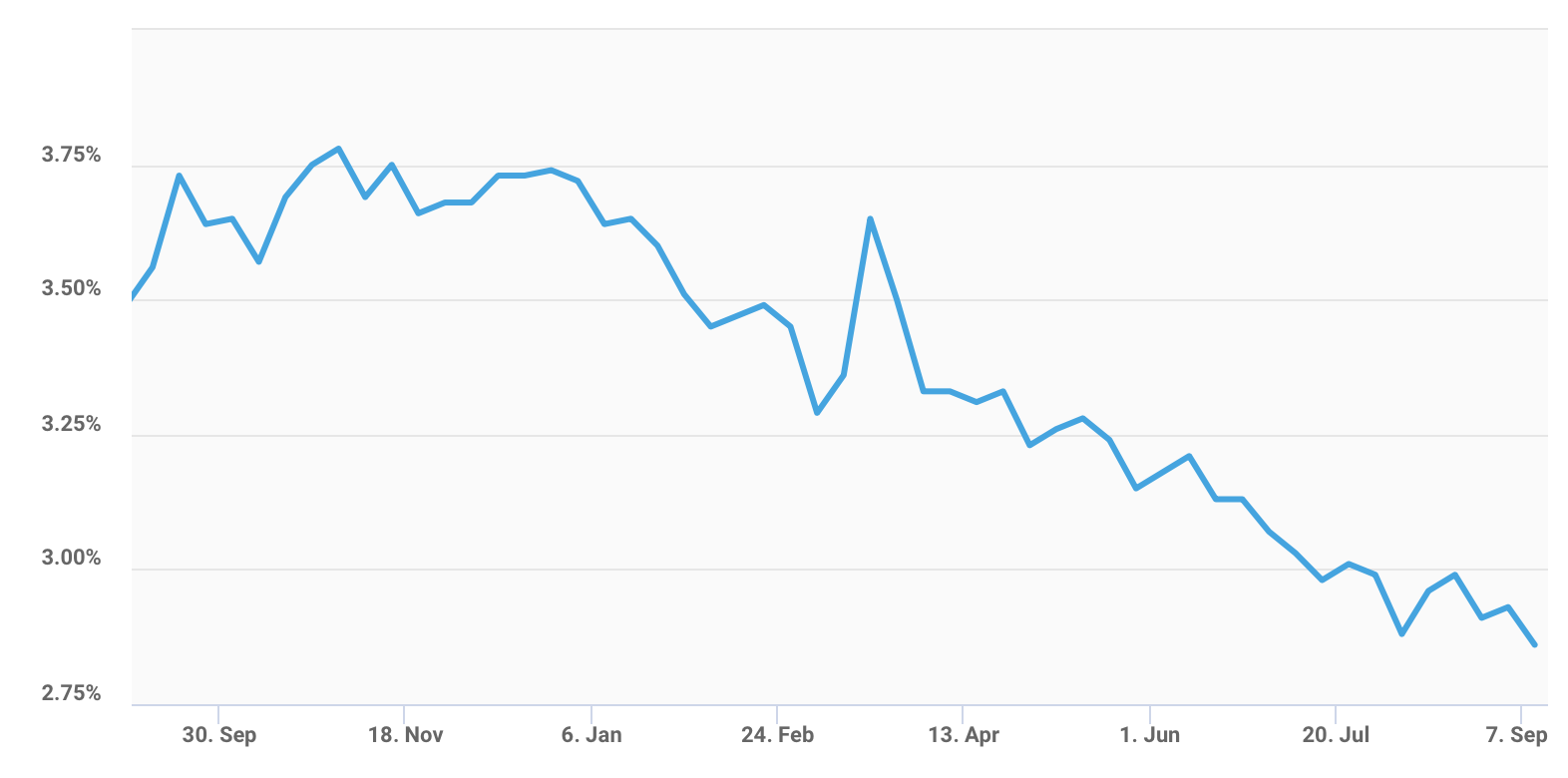

Mortgage Rates At Historic Lows Again 02038 Real Estate

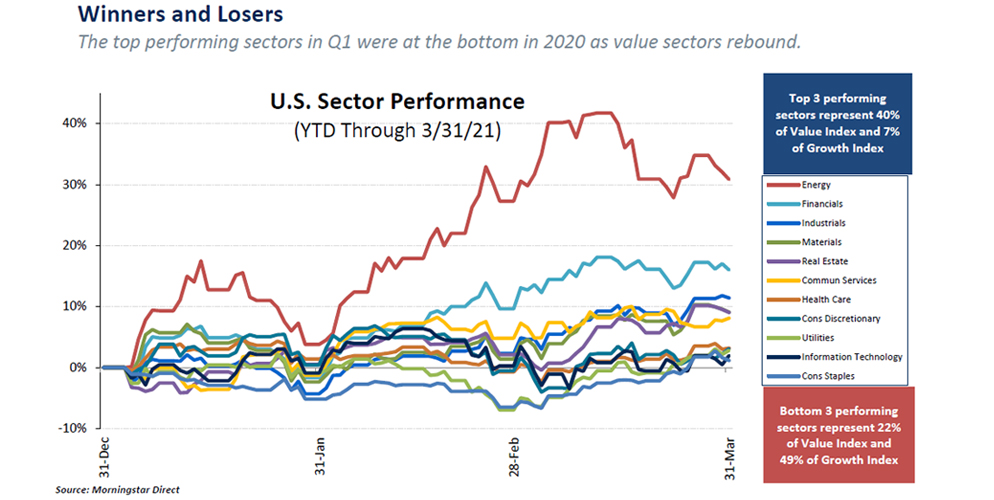

First Quarter 2021 Recap

Mortgage Loan Trading Platforms How To Choose For Secondary Market

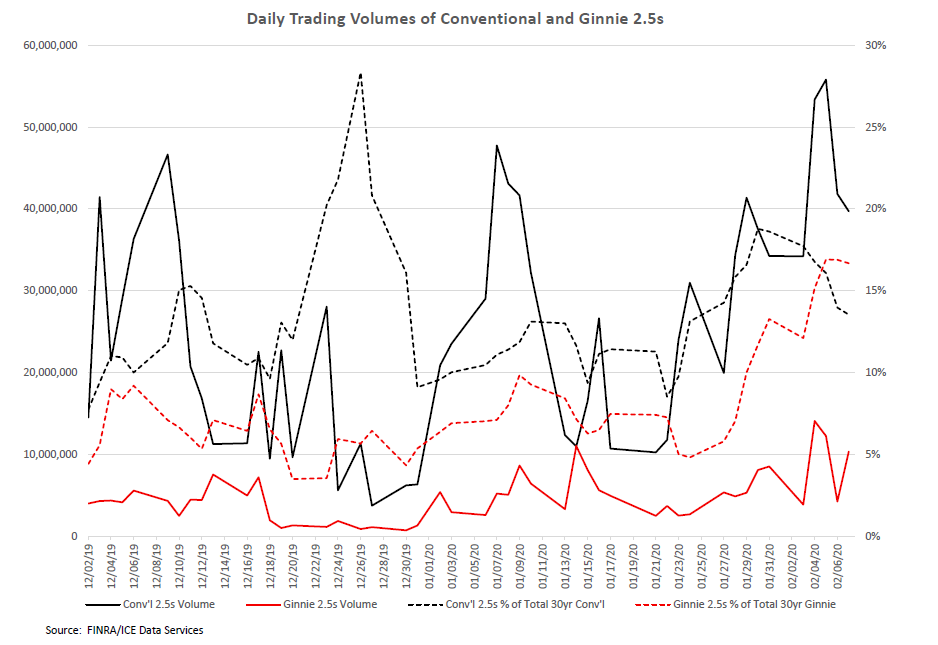

Mbs Weekly Market Commentary Week Ending 02 07 20 Mortgage Capital Trading Mct

2

What Is The Difference Between A Loan Officer Mortgage Broker Banker And Other Lenders Mortgage Brokers Mortgage Lenders Mortgage

Free Printable Debt Payoff Coloring Page Credit Card Debt Payoff Credit Card Tracker Credit Card Interest

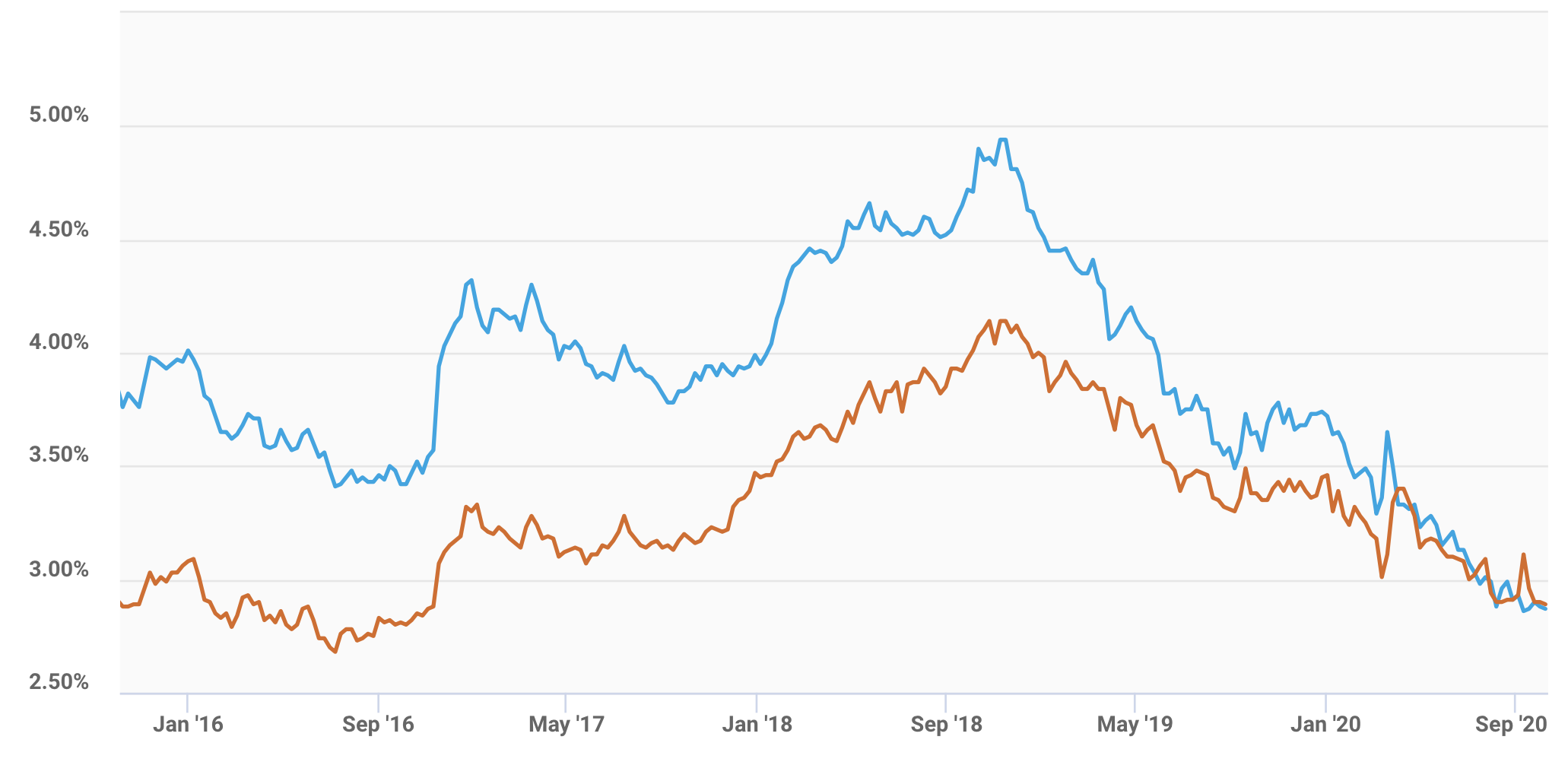

California Mortgage Rates Trends 30 Year Fixed Better Than Arm Loan

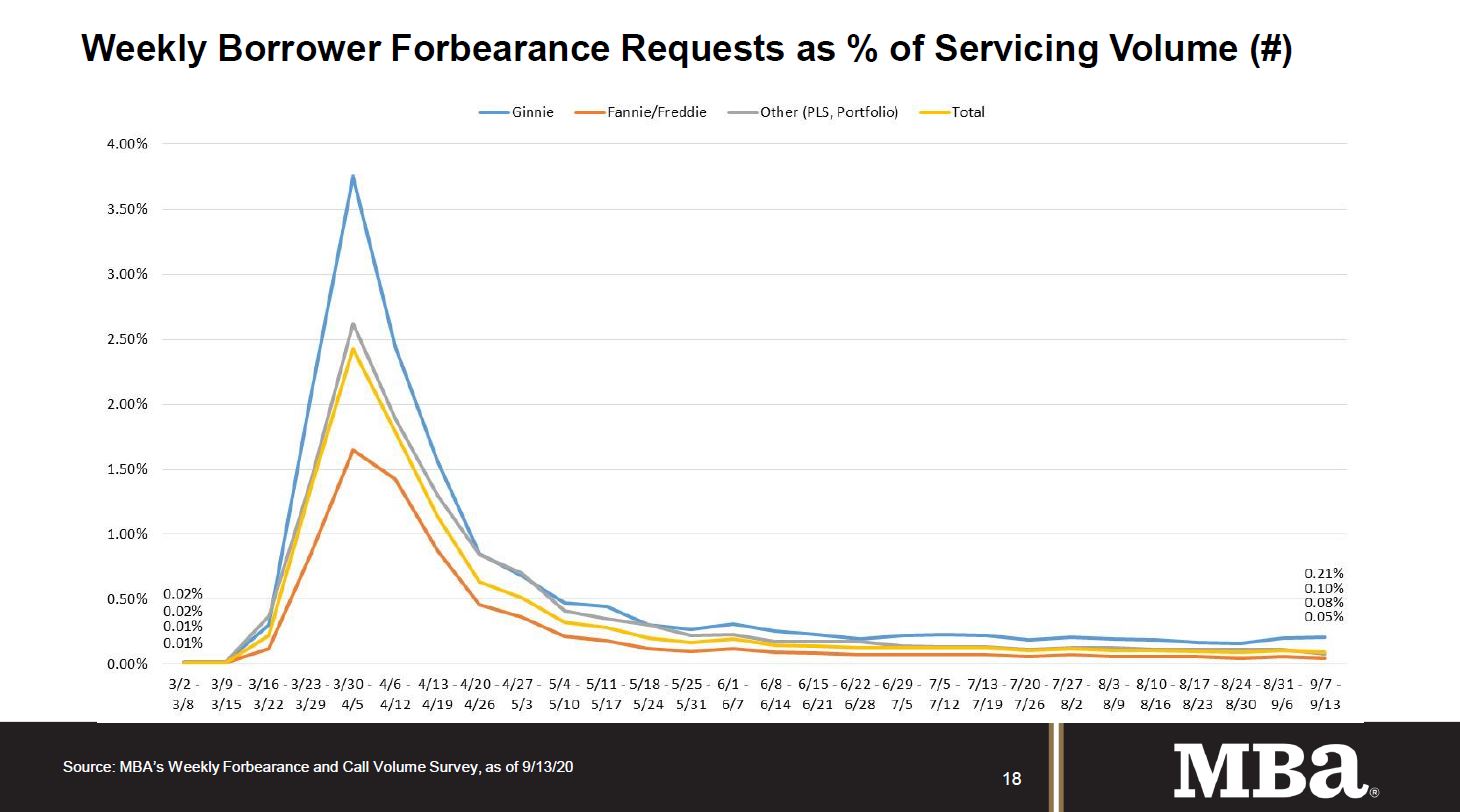

Msr Forbearance In 2020 Challenges Recommendations Mortgage Capital Trading Mct

Buying A Home In The Bay Area In 2021 Three Things You Should Know

My Site Roc Blog

Gold A Safe Haven Asset If Stagflation Lasts In Europe Goldbroker Com

Enron Scandal The Fall Of A Wall Street Darling

Fannie Mae And Freddie Mac Stock Prices July 2007 December 2008 Download Scientific Diagram

Those Buying A Home In The Bay Area In 2022 Might Want To Hurry